Not known Details About Property By Helander Llc

Not known Details About Property By Helander Llc

Blog Article

The Basic Principles Of Property By Helander Llc

Table of ContentsA Biased View of Property By Helander LlcSee This Report about Property By Helander LlcThe Definitive Guide for Property By Helander LlcThe Ultimate Guide To Property By Helander LlcProperty By Helander Llc for DummiesExcitement About Property By Helander Llc

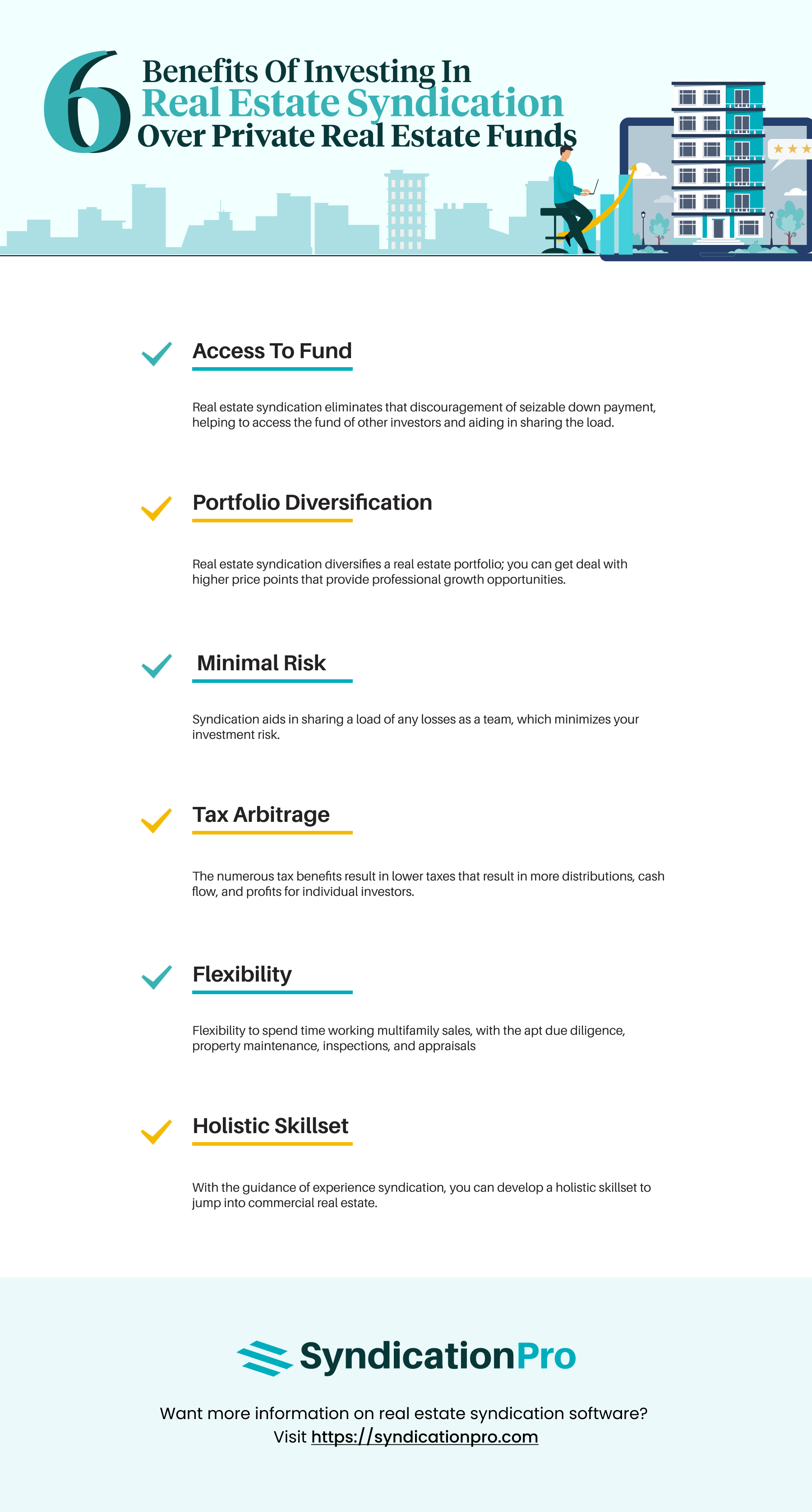

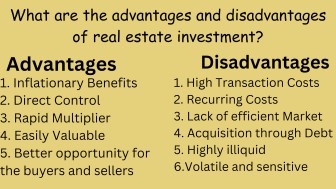

The advantages of purchasing real estate are various. With appropriate properties, financiers can delight in foreseeable capital, superb returns, tax obligation advantages, and diversificationand it's possible to take advantage of realty to develop wide range. Thinking concerning purchasing property? Here's what you require to learn about actual estate benefits and why property is thought about an excellent investment.The advantages of investing in real estate include easy earnings, stable cash money flow, tax obligation benefits, diversity, and leverage. Real estate investment counts on (REITs) supply a method to invest in real estate without having to own, run, or financing residential properties.

In most cases, capital only enhances gradually as you pay down your mortgageand accumulate your equity. Genuine estate investors can make the most of many tax breaks and reductions that can save cash at tax time. As a whole, you can subtract the practical prices of owning, operating, and handling a residential or commercial property.

Top Guidelines Of Property By Helander Llc

Real estate values tend to increase over time, and with a great financial investment, you can turn an earnings when it's time to sell. As you pay down a residential or commercial property home mortgage, you build equityan asset that's component of your internet well worth. And as you construct equity, you have the leverage to purchase even more buildings and increase money circulation and riches also a lot more.

Because realty is a concrete property and one that can serve as collateral, funding is readily offered. Realty returns vary, relying on elements such as area, asset course, and administration. Still, a number that numerous investors go for is to beat the ordinary returns of the S&P 500what lots of people refer to when they say, "the marketplace." The rising cost of living hedging ability of actual estate originates from the positive relationship in between GDP development and the need for real estate.

Property By Helander Llc for Dummies

This, in turn, converts right into greater resources values. Actual estate often tends to keep the purchasing power of funding by passing some of the inflationary stress on to lessees and by integrating some of the inflationary pressure in the type of funding recognition - sandpoint idaho realtors.

Indirect actual estate spending includes no straight ownership of a residential or commercial property or properties. Rather, you buy a swimming pool in addition to others, whereby an administration company possesses and operates homes, or else has a portfolio of home loans. There are several manner ins which owning actual estate can shield against rising cost of living. Initially, building worths might climb greater than the price of rising cost of living, causing capital gains.

Lastly, residential properties funded with a fixed-rate funding will see the family member amount of the month-to-month mortgage settlements tip over time-- for example $1,000 a month as a set payment will certainly become less difficult as inflation wears down the purchasing power of that $1,000. Often, a key residence is not thought about to be an actual estate investment given that it is made use of as one's home

Property By Helander Llc Can Be Fun For Anyone

Despite the assistance of a broker, it can take a couple of weeks of job just to discover the appropriate counterparty. Still, realty is an unique asset course that's basic to understand and can boost the risk-and-return profile of a capitalist's portfolio. On its very own, realty offers money circulation, tax obligation breaks, equity structure, affordable risk-adjusted returns, and a hedge versus inflation.

Spending in realty can be an extremely rewarding and rewarding venture, but if you're like a great deal of brand-new financiers, you might be asking yourself WHY you ought to be purchasing realty and what benefits it brings over other investment possibilities. In enhancement to all the fantastic benefits that come along with spending in actual estate, there are some downsides you need to take into consideration.

Facts About Property By Helander Llc Uncovered

At BuyProperly, we make use of a fractional possession design that enables financiers to start with as little as $2500. Another major advantage of genuine estate investing is the capability to make a high return from acquiring, restoring, and marketing (a.k.a.

Most flippers a lot of fins undervalued buildings in structures neighborhoods. The terrific thing concerning investing in genuine estate is that the value of the residential property is expected to appreciate.

The Basic Principles Of Property By Helander Llc

For instance, if you are charging this post $2,000 lease monthly and you sustained $1,500 in tax-deductible costs monthly, you will only be paying tax obligation on that particular $500 earnings per month. That's a large difference from paying taxes on $2,000 each month. The profit that you make on your rental system for the year is taken into consideration rental income and will certainly be taxed accordingly

Report this page